Have you ever wondered how students manage their loans after graduation? Student loan management is something that many students have to deal with after they finish their studies. It involves keeping track of the loans they’ve taken for school, making payments on time, and understanding how to reduce the amount they owe. Managing student loans properly is key to avoiding future financial problems and building a strong financial future. In this article, we will learn how to write an essay on student loan management and explore strategies to handle it effectively.

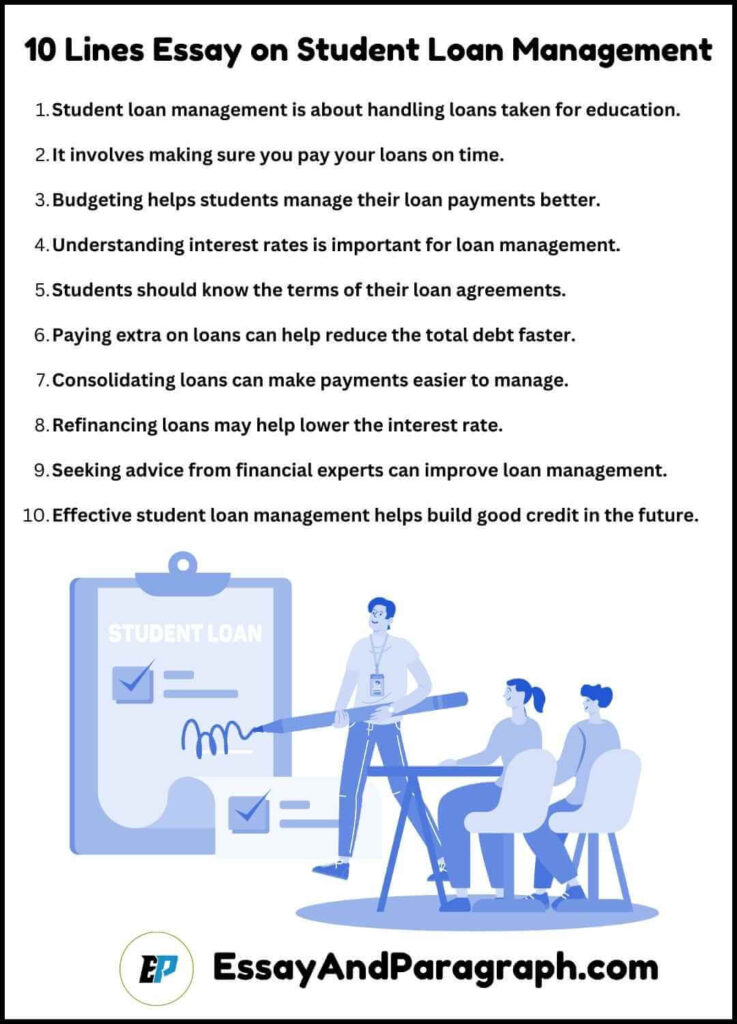

10-Line Essay on Student Loan Management

- Student loan management is about handling loans taken for education.

- It involves making sure you pay your loans on time.

- Budgeting helps students manage their loan payments better.

- Understanding interest rates is important for loan management.

- Students should know the terms of their loan agreements.

- Paying extra on loans can help reduce the total debt faster.

- Consolidating loans can make payments easier to manage.

- Refinancing loans may help lower the interest rate.

- Seeking advice from financial experts can improve loan management.

- Effective student loan management helps build good credit in the future.

Short Essay on Student Loan Management

Managing student loans is a responsibility that every student should take seriously. After graduation, many students face the challenge of repaying the loans they took to fund their education. The first step in managing student loans is to understand the details of the loan, including the amount owed, the interest rate, and the repayment schedule. This helps students stay on track and avoid missing payments.

Another key part of student loan management is budgeting. By creating a monthly budget, students can allocate enough money to pay their loans and avoid overspending on non-essential items. Additionally, it’s important to consider paying extra on the loans, even if it’s just a small amount. This helps reduce the overall debt and saves money on interest in the long run.

Some students may benefit from consolidating their loans. Loan consolidation combines multiple loans into one, making it easier to manage monthly payments. Alternatively, refinancing loans may help lower the interest rates, reducing the total amount to be paid. Seeking guidance from a financial advisor is also a good idea for students who need help navigating their loan management options.

In the long term, good student loan management can help students build a solid financial foundation, leading to better credit and fewer financial worries in the future.

Long Essay on Student Loan Management

Student loan management is one of the most important financial skills a student can learn. Many students rely on loans to pay for their education, but understanding how to handle these loans properly after graduation is crucial to financial stability. Student loan management refers to the process of keeping track of loans, making timely payments, and exploring options to reduce debt efficiently.

The first step in managing student loans is understanding the terms of the loan. When you borrow money for school, it’s important to know how much you owe, what the interest rate is, and when the payments are due. Many loans also have a grace period, which is the time you have after graduation before you must start making payments. It’s important to make use of this period to prepare for the payments ahead.

Budgeting plays a major role in managing student loans. As a student or a recent graduate, creating a monthly budget will help ensure that enough money is set aside for loan payments. By carefully tracking income and expenses, students can avoid overspending on things like entertainment or unnecessary purchases. This way, more money can go toward paying off loans, reducing the debt over time.

Additionally, understanding the different loan repayment options available is key to effective loan management. Some students may find it helpful to consolidate their loans, which involves combining multiple loans into one, making the repayment process easier. Refinancing loans is another option, where students can apply for a new loan with a lower interest rate to reduce the amount owed. Both options can lead to lower monthly payments, making it more manageable for students to keep up with their obligations.

Paying more than the minimum payment each month can also help students save money in the long term. By paying extra, students can reduce the overall debt and shorten the length of time it takes to pay off the loan. This not only helps with financial freedom but also reduces the interest costs that accumulate over time.

In conclusion, managing student loans requires careful planning and attention. By understanding loan terms, budgeting, exploring repayment options, and making extra payments, students can reduce their debt faster and avoid future financial stress. Managing student loans effectively is essential for building good credit and achieving financial stability.

FAQs

1. What is student loan management?

Student loan management involves understanding and managing the loans you took to finance your education. This includes making timely payments, understanding the loan’s interest rates and terms, and finding ways to reduce the amount you owe over time. Proper student loan management can help you avoid financial difficulties in the future.

2. How can I manage my student loans better?

To manage your student loans effectively, you should first understand your loan terms and repayment schedule. Create a budget to ensure you set aside money for your loan payments each month. Consider paying more than the minimum payment to reduce your debt faster. You can also explore loan consolidation or refinancing options to make payments easier or lower the interest rate.

3. What are the benefits of consolidating student loans?

Consolidating student loans allows you to combine multiple loans into one, making it easier to keep track of payments. This can simplify your finances and reduce the number of monthly payments you have to make. It may also result in lower monthly payments, depending on the terms of the consolidation.

4. Is it a good idea to refinance my student loans?

Refinancing your student loans can be a good idea if you can secure a lower interest rate, as it can reduce the amount you owe over time. It may also lower your monthly payments, making them more manageable. However, it’s important to compare rates and terms carefully before refinancing to ensure it’s the best option for you.

5. How can I reduce the amount I owe on my student loans?

You can reduce the amount you owe on your student loans by making extra payments, consolidating or refinancing your loans, and exploring income-driven repayment plans. Paying more than the minimum payment will help reduce the principal balance faster, leading to less interest paid over time.

Top 5 Quotes on Student Loan Management

- “The best way to manage your student loans is to start paying them off as soon as possible.” – Unknown

- “A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

- “The key to managing student loans is to understand them and stay on top of payments.” – Unknown

- “Student loan debt is a serious issue, but with the right approach, you can pay it off sooner than you think.” – Unknown

- “Don’t let your student loan debt control you; take control of your loans and your financial future.” – Unknown

Summary on Student Loan Management

Managing student loans is essential for building a secure financial future. By understanding the terms of your loans, creating a budget, and exploring repayment options like consolidation or refinancing, you can reduce your debt over time. Paying extra toward your loans and making timely payments will help you pay them off faster, saving you money in the long run. Good student loan management also helps build strong credit and reduces financial stress, paving the way for a brighter financial future.